Provectus First Quarter 2024 Conference Call Script

This script was used to conduct the call on Thursday, February 22nd at 3 pm EST.

Alyssa.

Good afternoon.

Welcome to the First Quarter 2024 Conference Call of Provectus Biopharmaceuticals, which is developing immunotherapy medicines for cancer and other diseases.

My name is Alyssa Barry, co-founder and principal of investor relations firm irlabs. I am hosting today’s call.

Ed Pershing, chairman of Provectus’s board of directors, and Dominic Rodrigues, board vice chairman, will provide Company updates and their remarks.

First, Nathan Kibler, Provectus’s outside legal counsel from the law firm of Baker Donelson, will read the Company’s forward-looking statements.

Nathan.

Thank you, Alyssa.

The information provided on this conference call may include forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, relating to the business of Provectus and its affiliates, which are based on currently available information and current assumptions, expectations, and projections about future events and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “aim,” “likely,” “outlook,” “seek,” “anticipate,” “budget,” “plan,” “continue,” “estimate,” “expect,” “forecast,” “may,” “will,” “would,” “project,” “projection,” “predict,” “potential,” “targeting,” “intend,” “can,” “could,” “might,” “should,” “believe,” and similar words suggesting future outcomes or statements regarding an outlook.

The safety and efficacy of Provectus’s drug product candidates and/or their uses under investigation have not been established. There is no guarantee that these agents will receive health authority approval or become commercially available in any country for the uses being investigated or that such agents as products will achieve any revenue levels.

Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, listeners should not place undue reliance on these forward-looking statements. The forward-looking statements discussed on this conference call are made as of the date hereof or as of the date specifically specified herein, and the Company undertakes no obligation to update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except in accordance with applicable securities laws. The forward-looking statements are expressly qualified by this cautionary statement.

Risks, uncertainties, and assumptions include those discussed in Provectus’s filings with the U.S. Securities and Exchange Commission, including those described in Item 1A of the Company’s Annual Report on Form 10-K for the period ended December 31, 2022 and Provectus’s Quarterly Report on Form 10-Q for the period ended September 30, 2023.

Alyssa.

Thank you, Nathan.

Ed will now make his opening remarks.

Ed.

Thank you, Alyssa.

We are very pleased to have irlabs join our team as Provectus seeks to increase its investor communications and engagement, and expand the Company’s visibility and outreach to the investment community.

Our vision, governing philosophies, and corporate goals are the foundation of why and how I have led Provectus. These points inspire me because I believe the Company is on the cusp of potentially showing the extraordinary promise in pancreatic cancer that cancer immunotherapy PV-10 and synthetic small molecule rose bengal sodium can truly exhibit. These points also comprise the rationale for my stepping in to lead Provectus as it teetered on the brink of collapse following the resignation of its former CEO and co-founder in early-2016 and termination of its former CFO in late-2016.

My leadership of Provectus draws upon almost fifty years of work experience in several different areas of the healthcare sector and a track record of assembling and leading teams to start and build half-a-dozen thriving, profitable companies and successfully turning around dozens of other existing businesses and organizations.

At various times, former Provectus strategic advisory board members in senior positions at pharma companies, principal investigators at U.S. and international academic medical centers involved in PV-10 clinical trials and expanded access programs, pharma company search-and-evaluations teams, and the FDA acknowledged PV-10’s potential (in the case of the FDA, its drug activity). Some identified PV-10’s data paucity and data gaps, which I believe the Company has since been addressing.

Turning around a biotech company you did not create is a very different business proposition than in any other area of the healthcare sector. You cannot slash-and-burn or start-from-scratch in the situation where other people created a compelling, emerging drug therapy that patients and clinicians are using.

As circumstances unfolded since 2017, we secured and transferred existing scientific knowledge from Provectus’s former co-founders to us and created new scientific insights. We have proactively and sometimes reactively zigged and zagged to backfill clinical datasets, tested medical and scientific hypotheses such as the importance of potentially improving clinical outcomes of metastatic patients by targeting hepatic disease, increased PV-10’s dosing regimen, optimized clinical trial protocols, generated new and expanded existing clinical and preclinical datasets, and sought and validated regulatory strategy and affairs feedback and counsel.

I believe Provectus is well-positioned to advance immunotherapy PV-10 in its lead indication of hepatic metastatic pancreatic cancer towards a potential, defined approval pathway, and successfully traverse it.

I believe forthcoming preclinical datasets could clearly show the vast, potential, broad-spectrum therapeutic applications of synthetic small molecule rose bengal sodium.

I want to conclude my opening remarks with comments about Provectus’s business philosophy. I believe maximizing patient outcomes from drug therapies and patient access to those medicines maximize return on investment and shareholder value.

According to the American Cancer Society’s 2024 statistics, the incidences of many common cancers, including six of the top 10 (breast, prostate, endometrial, pancreatic, kidney, and melanoma) are increasing. This present situation exacerbates the 2019 statistics of socioeconomic inequalities widening in the poorest American counties where cancer mortality rates were higher because of inadequate access to leading cancer treatments, or treatment at all, among other factors. It is an American horror story that financial toxicity from cancer treatment directly contributes to significant patient and family stress, debt, and bankruptcy.

When the time comes, I believe Provectus can potentially price its future drugs commensurate with the research and development risk that the Company has taken and produce generous gross profit margins that reflect the cost of manufacturing small molecule drugs. I believe Provectus’s simple and elegant, yet complex manufacturing innovation for making rose bengal sodium can lengthen PV-10 and other Company drugs’ time-to-peak sales by potentially protecting future drug franchises longer.

Provectus’s scorecard for its future drugs will not be just how much money they generate from prescriptions, but the number of patients they successfully treat in a meaningful, durable way as the Company pursues financial success.

Ed.

Since saving the Company and its profound medical science from the ash heap of history in 2017, our strategic plan has been consistently two-fold.

One, secure the right cancer indication for PV-10 to achieve its first approval. Choosing that right indication has been an exercise in optimizing various considerations, including clinical outcomes and datasets, treatment standards, regulatory strategies, addressable markets, appropriate partners, and other factors.

Two, prove that rose bengal sodium is an immunotherapeutic molecule for cancer, and applicable to other diseases. We began this at the outset of our tenure at the Company by greenlighting mechanisms of action and immune action research on Provectus’s immuno-dermatology drug PH-10, a clinical-stage asset that people at the Company wanted to discard. This research revealed PH-10’s potential curative properties for psoriasis, identified its multi-immune signaling possibilities that were later confirmed by research on PV-10 for cancer, and deeply influenced subsequent research on rose bengal sodium as a possible multi-disease, broad-spectrum immunotherapeutic.

I believe this two-fold business strategy for Provectus is firmly grounded in science, economics, and fundamental shareholder value creation.

Provectus has collaborated with medical researchers in the U.S., Canada, and elsewhere to reproducibly and repeatably show that PV-10’s mechanisms are cancer and tumor type agnostic, multi-faceted, immune system-engaged, comprehensive, integrated, and consistent.

Further, the Company has collaborated with researchers to explore, discover, and show that these therapeutic mechanisms, and more, are consistent in other disease areas beyond cancer. This work has been and continues to be done as part of our efforts to maximize the potential value of the Company’s medical science platform for Provectus shareholders.

On today’s call, Dominic will explain that, while we believe PV-10’s clinical data is compelling, regulatory bodies and pharma companies require randomized controlled trial data as a minimum hurdle to garner regulatory recognition or partnership. The feedback we have sought along this journey has been important input to our decision-making.

Our areas of focus for 2024 are keenly related to trying to further improve the Company’s market capitalization.

One, start an FDA-cleared, lead clinical development program for hepatic metastatic pancreatic cancer.

Two, continue to raise capital at valuations that respect the fundamental value of Provectus and try to pursue corporate development that can potentially unlock the true value of the Company’s platform.

Three, increase Provectus’s investor communications and engagement and expand the Company’s visibility and outreach to the investment community.

Dominic will now discuss Provectus’s clinical development programs in cancer and the Company’s work in other disease areas.

Dominic.

Thank you, Ed.

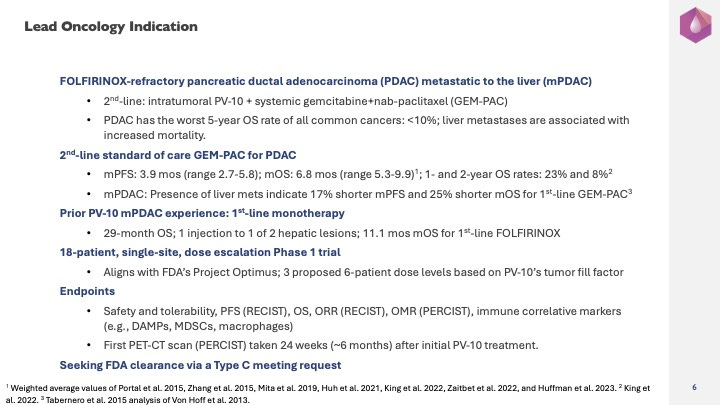

Provectus’s lead oncology indication is FOLFIRINOX-refractory pancreatic ductal adenocarcinoma (or PDAC) metastatic to the liver (or mPDAC).

At less than 10%, PDAC has the worst five-year overall survival rate of all common cancers. Liver or hepatic metastases, which are common, are associated with increased mortality.

Intratumorally administered PV-10 will be combined with systemically administered chemotherapies gemcitabine and nab-pacitaxel (or GEM-PAC). GEP-PAC is the standard of care in second line when first line systemic chemotherapy regimen FOLFIRINOX fails patients.

Survival data in metastatic pancreatic cancer for GEM-PAC as second line to FOLFIRINOX are available from several clinical trials, such as Portal et al. 2015, Zhang et al. 2015, Mita et al. 2019, Huh et al. 2021, King et al. 2022, Zaitbet et al. 2022, and Huffman et al. 2023. The fraction of patients with metastatic disease and the fraction of metastatic patients with liver metastases varies. Of these studies where at least 80% of patients had metastatic disease, the weighted average median overall survival and progression-free survival were 6.8 months (range 5.3-9.9) and 3.9 months (range 2.7-5.8), respectively. In King et al. 2022, one- and two-year overall survival were 23% and 8%, respectively. Tabernero et al. 2015’s analysis of Von Hoff et al. 2013 (first line GEM-PAC) showed that the presence of liver metastases was strongly prognostic of an increased risk of death: 25% shorter median overall survival (8.3 months for hepatic disease versus 11.0 months for none) and 17% shorter progression-free survival (5.4 months versus 6.5 months).

Provectus previously treated an 83-year-old mPDAC patient who received first-line single-agent PV-10, one injection to one of two liver metastases. The patient received no other treatment, declined systemic chemotherapy, and survived for 29 months before succumbing to disease progression. Conroy et al. 2011 shows 11.1 months as the median overall survival for first line FOLFIRINOX and an overall survival rate of 2% at 30 months.

The Company plans to run an 18-patient, currently proprietary single-site, dose escalation Phase 1 trial that Provectus believes should align with FDA initiative Project Optimus and its dose optimization principles. Three proposed six-patient dose levels would be tried by varying PV-10’s tumor fill factor, which essentially represents the amount of rose bengal sodium given to a patient’s injectable tumor burden. Fill factor is the ratio of the volume of PV-10 injected into a lesion to the lesion’s estimated volume. The high dose of 50% (half the lesion volume or 0.5 mL of PV-10 per cubic centimeter of lesion volume) has been the typical fill factor for treating patients with liver metastases in Provectus clinical trials.

In contrast, traditional dosing of systemic therapies is based on the amount of drug given to the patient (a ratio of the amount of drug to the patient’s weight) to assess efficacy potential while monitoring safety and tolerability. Further, while dosing of competing intratumoral biologic drugs (oncolytic virus Imylgic) and drug product candidates (oncolytic viruses, viral-vectored gene therapies) embraces the fill factor concept, their mechanisms of action center around viral replication inside and outside of the four walls of the injected lesion.

Whereas PV-10’s well-established mechanism of action targets cancer cells within the injected lesion’s four walls before rose bengal sodium is quickly discharged by the body. PV-10’s well-documented mechanism of immune action suggests the immune system is doing the work outside of the four walls. We believe Provectus can scientifically and empirically connect mechanism to dosing for the FDA.

We believe Provectus’s clinical work and supportive historical biomedical literature already define rose bengal sodium’s and thus PV-10’s safety profile. While it is necessary to establish a dose response under Project Optimus’s framework, we think it is critical to safely maximize PV-10’s dosing to maximize a patient’s response and their long-term outcome.

Provectus’s goals for the mPDAC study are three-fold.

One, safely inject enough PV-10 into enough liver metastases enough times for long enough.

Two, show whether PV-10 plus GEMP PAC can exceed standard of care GEM-PAC’s historical second line benefit.

Three, show whether PV-10 can put patients on a trajectory towards curative outcomes.

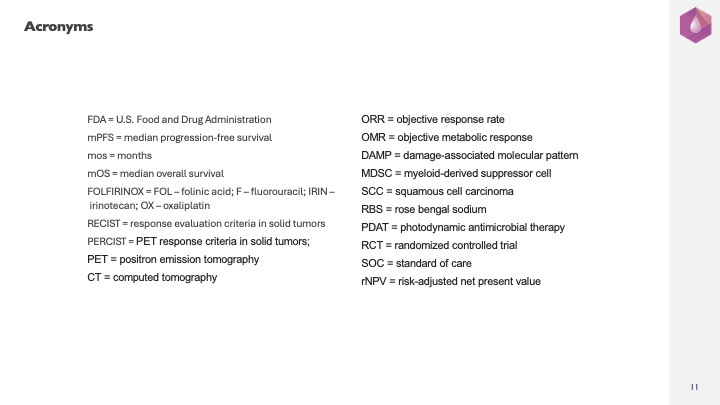

Proposed endpoints are safety and tolerability, progression-free survival by RECIST for primary efficacy, overall survival, and immune correlative markers. Provectus plans to measure objective response by RECIST and objective metabolic response by PERCIST via positron emission tomography–computed tomography (or PET-CT) scan. PERCIST may be more suitable for assessing tumor response and patient disease status after anti-cancer treatment than RECIST; however, RECIST is the customary yardstick for measuring response in oncology clinical trials. The first PET-CT scan would be at 24 weeks, or about six months, after initial PV-10 treatment. If most patients are having their first PET-CT scan, the mPDAC study is potentially in good shape. Overall survival would very likely be the primary endpoint of the potential next clinical trial step.

The Company’s immune correlative work is designed to confirm or refute PV-10’s established innate immune system signaling, the release of damage-associated molecular pattern molecules, and explore the potential implication of myeloid-derived suppressor cells (based on preclinical research at Moffitt Cancer Center) and/or macrophages (favored by the study’s principal investigator).

Based on estimates from the investigator, enrollment time could be 12 to 18 months, or less. Provectus plans to do multiple interim assessments, such as for each dose level cohort, and a preliminary assessment of full study results.

The Company plans to seek FDA clearance for the mPDAC program and its initial trial via a Type C meeting request. Provectus would clearly communicate its authentic desire to partner with the FDA for PV-10’s drug development.

Pharma company search and evaluations teams want randomized controlled trial data of PV-10 versus standard of care in a cancer indication of interest for possible co-development, licensure, or M&A. Pharma companies do not directly tell us what study to run, but, based on Provectus’s datasets and external feedback, we are confident that data from a successful, comprehensive, well-designed, data-rich, efficient mPDAC study under FDA clearance compared to established, well-characterized, historical standard of care GEM-PAC data is a potential catalyst for company recognition in the pharma and investment communities. The better the data are, the better a deal can be. Best data are if PV-10 can hit for both average and power; that is, many more PV-10-treated mPDAC patients respond and live much longer than those on GEM-PAC.

I believe Provectus has very meaningfully addressed historical PV-10’s data paucity and data gaps over the last several years in three very important ways.

One, by collecting and collating durability of response and overall survival of patients treated with PV-10 in superficial and visceral cancer indications.

Two, by trying to safely maximize PV-10’s dosing regimen, which could potentially increase the probability of success of the mPDAC trial. We believe enough PV-10 injections enough times to enough lesions for long enough can lead to durable systemic responses and long-term outcomes for patients. A little PV-10 can go a long way, but enough PV-10 might cure you.

Three, by identifying and validating that the treatment of metastatic cancers by primarily treating liver metastases is key to potential positive long-term patient outcomes, irrespective of the presence of hepatic-only or both hepatic and extrahepatic disease.

Increased PV-10 dosing (compared to Provectus’s historical underdosing of patients) led to durable systemic responses and long-term outcomes in advanced cutaneous melanoma and hepatic metastatic uveal melanoma patients. Further, PV-10 potentially improved the prognosis of patients with PV-10-treated hepatic metastases with or without extrahepatic disease.

For six Stage III melanoma patients receiving PV-10 and checkpoint inhibitor pembrolizumab, objective response by RECIST was 83%; 50% of patients achieved a rapid, durable, complete response and were ongoing after up to nearly four years; median progression-free survival had not yet been reached; and median overall survival was about three years, but this figure could change because of the status of the last patient who was an ongoing complete responder at two-and-a-half years.

For four uveal melanoma patients who received monotherapy PV-10 or PV-10 and dual checkpoint inhibitors ipilimumab and nivolumab, complete metabolic responses were ongoing after a median time of more than three years, ranging from more than two years to more than five; and median overall survival had not yet been reached. Further, comparing M1a-staged patients with or without extrahepatic disease who received PV-10, ipilimumab, and nivolumab to historical patients who received ipilimumab and nivolumab (Pelster et al. 2021), median overall survival was more than four years versus about one year.

As we prepare to start the mPDAC trial, I believe the totality of Provectus’s data speak for themselves. I believe a patient who receives enough PV-10 treatment to enough of their injectable hepatic tumor burden can potentially achieve complete metabolic response, which could potentially be prognostic of a positive long-term outcome for them.

Finally, Provectus’s oncology clinical development strategy carefully considers the Company’s data and cancer indications where PV-10 can beat standard of care, best display its own immunotherapeutic capabilities (potential synergy with other drugs notwithstanding), and produce the highest risk-adjusted net present value (or rNPV). rNPV is a key valuation method plied by the pharma and investment communities to place an estimated value or price on a biopharma asset.

I believe Provectus possesses several attractive PV-10 datasets in different cancer types. Taking a given indication and the proposed line of treatment, the amount and quality of the Company’s supporting data, the likelihood of an overall survival endpoint for drug approval, the indication’s standard of care, the likely number of patients required for a randomized controlled trial, the likely length of time to show clinical benefit, an assessment of the PV-10 treatment arm’s potential effect size, and an assessment of the likelihood of success, Provectus’s consequential study ranged from potentially several hundred patients and years for treatment-naïve Stage III cutaneous melanoma to dozens and dozens of patients and many months for treatment-naïve metastatic uveal melanoma to tens of patients and months for FOLFIRINOX-refractory mPDAC. PV-10’s potential rNPV for mPDAC is significantly higher than for Stage III melanoma. Third line hepatic metastatic neuroendocrine tumor’s rNPV was the lowest; however, this work showed that limited PV-10 dosing could still achieve durable stable metabolic disease via PERCIST in patients.

Dominic.

Provectus could potentially initiate two other oncology clinical trials in 2024.

One, Provectus is currently evaluating a single-site randomized controlled trial for treatment-naïve, M1a-staged, hepatic metastatic uveal melanoma comparing PV-10, ipilimumab, and nivolumab to ipilimumab and nivolumab, which is an institutional standard of care at MD Anderson Cancer Center, where initial clinical study was done.

Provectus is considering a survival-based endpoint, such as an 18-month overall survival rate. The Company’s clinical data favorably compares with historical clinical data of a competing treatment: 50-month median overall survival of PV-10, ipilimumab, and nivolumab versus ipilimumab and nivolumab’s 12.8 months. Here too, Provectus is focused on timely enrollment.

Two, the Company could participate in an 18-patient, currently proprietary single-site, investigator-initiated study of pre-operative PV-10 for penile squamous cell carcinoma (or penile SCC), where standard of care is a penectomy, the partial or total surgical removal of the patient’s penis. The clinical site in question is one of two academic medical centers in the U.S. that purportedly see substantially all penile SCC patients seeking treatment. The study’s co-principal investigators (a surgical oncologist and a medical oncologist) have given us insight into potential enrollment rates. Investigator-initiated studies can be less expensive than company-sponsored studies, and their data can potentially be utilized in regulatory agency discussions assuming a well-designed protocol is executed well with diligent and thorough collection of comprehensive safety, tolerability, and efficacy data.

This study has the potential to highlight both categories of PV-10’s mechanisms of action.

One, timely, substantial or complete tumor response to PV-10 injection, thereby possibly reducing the amount of penectomy required or maybe even eliminating the need for it at all.

Two, a potential robust immune system response mounted by PV-10 treatment.

Provectus is finalizing an exclusive worldwide license agreement with the University of Miami’s Office of Technology Transfer for the intellectual property of Bascom Palmer Eye Institute’s Ophthalmic Biophysics Center for its rose bengal photodynamic antimicrobial therapy that has purportedly been used to treat more than 400 patients to date for infectious keratitis. This license transaction could potentially be completed in March. Bascom Palmer has termed its treatment groundbreaking.

Aside from collaborating on viable, clinical, proof-of-concept treatments involving rose bengal sodium that appear to work, seeking this license can marry Provectus’s potentially FDA-approvable pharmaceutical-grade active pharmaceutical ingredient with Bascom Palmer’s world-class expertise and worldwide reputation to produce a drug formulation based on the Company’s potentially sustainable source of drug substance rose bengal sodium to treat patients worldwide, especially outside of the U.S. where infectious keratitis has a greater likelihood of leading to blindness

Ophthalmology is a possible disease-focused, majority Provectus-owned, privately held, spinout start-up biotech business to which Provectus could contribute its Bascom Palmer license and exclusive access to the necessary supply of the Company’s rose bengal sodium for this and other eye treatments. Provectus has also made a patent application for the use of lower rose bengal sodium concentrations and ambient or no light (that is, eye drops) for treating eye disorders and diseases.

Provectus expects several data readouts from ongoing preclinical research.

One, dermatology by The Rockefeller University. This work is important to further extend the original clinical PH-10 mechanism of action study in psoriasis, deepening investigation by including RNA sequencing. Depending on exactly how transcription is modified by PH-10 treatment, the implications for a range of skin diseases and potentially skin aging could be vast.

Two, PV-10 and head and neck SCC (or HNSCC) by Moffitt Cancer Center. Provectus expects a medical conference presentation and a peer-reviewed journal manuscript submission in 2024. This work is important on several fronts, including addressing both HPV-positive and HPV-negative HNSCC, being supportive of the aforementioned potential clinical penile SCC work by reproducing the underlying preclinical research in two different research groups with different cell lines, differentiating the activity of single-agent PV-10 and PV-10 in combination with checkpoint inhibition, and potentially positioning PV-10 for first- and/or second-line treatment when this indication enters the clinic.

Three, full-thickness cutaneous wound healing by the University of Texas Medical Branch at Galveston. The Company expects a medical conference presentation in 2024. This work is important to demonstrate the therapeutic utility of lower rose bengal sodium concentrations and ambient light, compared to these researchers’ original line of investigation combining higher concentrations and green light. The potential patient value proposition is rapid wound closure, scar mitigation or elimination, infection prevention, and/or return of function, as well as a broader array of application environments. This research positions the use of rose bengal sodium for surgical wounds and burns.

Four, canine soft tissue sarcomas by the University of Tennessee College of Veterinary Medicine. This work is important to provide the necessary in vitro activity and in vivo safety data that enable a pre-Investigational New Animal Drug (or INAD) meeting with the FDA and the eventual preparation and filing of an INAD application. A Phase 1 clinical trial at the University of Tennessee could potentially commence in 2024.

Five, there are other currently proprietary research projects in-process.

Ed.

When we first joined Provectus’s board of directors, I spoke with and/or interviewed several former biotech and pharma company executives to potentially assist us in righting the Company. At that time in 2017, none of them expressed substantive interest to advance PV-10 or learn more about rose bengal sodium. Well credentialed and experienced as they were, none displayed authentic interest in, passion and perseverance for, or curiosity about Provectus’s medical science and its promise for cancer patients and potentially patients suffering from other diseases. I believe the right, pertinent, fulsome, exciting dataset, such as from the Company’s hepatic metastatic pancreatic cancer clinical trial, can and will change their and others’ perception, reality, and ultimately excitement to join our team.

We are preparing for several Provectus corporate activities in 2024, including:

The Company will try to continue capital raising efforts at valuations that respect its fundamental value. We plan for the Company’s board of directors to appropriately consider undertaking and raising investment for possible disease-focused spinouts to create one or more majority Provectus-owned, privately held, start-up biotechnology businesses. This may prove to be the most effective pathway to rapidly advance approvals of medical applications in ophthalmology, wound healing, animal health, and/or dermatology. Valuations ascribed to private biotechnology companies may be more immediately reflective of fundamental value than what the over-the-counter stock market currently values Provectus at. This possible unlocking of the Company’s medical platform’s worth could be another means of enhancing Provectus shareholder value.

Provectus plans to increase its investor communications and engagement and expand its visibility and outreach to the investment community. To this end, we have engaged irlabs as a strategic communications advisor. Alyssa Barry, irlabs’s co-founder and principal, has been hosting today’s conference call.

There are no current plans for a Provectus reverse stock split. The Company will continue to seek annual stockholder approval for such authorization as a tactical option. A reverse split is not a means to an end, but rather a means to address Provectus’s capital structure and potentially increase the Company’s stock price, making Provectus’s common stock more attractive to a broader range of investors, such as institutional investors, professional investors, and other members of the investing public. If approved, Provectus may undertake a reverse split when the Company’s board of directors believes doing so would be in the best interests of Provectus’s shareholders.

Ed.

Thank you for joining us today on this conference all. I have some closing remarks.

Our vision for Provectus is based on our belief that maximizing shareholder value over time comes from maximizing patient outcomes from treatment and patient access to medicine.

We believe enhanced shareholder value could come from expanding Provectus’s medical science platform to treat diseases beyond cancer. This expansion could potentially come through compelling data and/or potential business spinouts.

In raising further investment, Provectus will continue its efforts to try to balance time-based corporate needs with the potential cost of shareholder dilution through disciplined capital raising and effective corporate development.

The regulatory, pharma, and investment communities want randomized controlled trial data of PV-10 compared to standard of care for a relevant, distinctive, cancer indication. We believe doing the right deal at the right time because of compelling, comprehensive, clinical datasets can potentially lead to much better outcomes for shareholders. This first dataset could come from the Company’s hepatic metastatic pancreatic cancer program.

By collaborating with irlabs, Provectus plans to increase its investor communications and expand its visibility and outreach to the investment community.

Topics discussed today will be elaborated on in greater detail on Provectus’s Substack, including providing the script that we used for this call and a recording of it, which will also be available on the Company’s website along with the call’s slides.

We look forward to hosting you at Provectus’s 2024 annual stockholder meeting in Knoxville in the second quarter. The Company is evaluating possibly webcasting the meeting for those shareholders who cannot attend in person.

Finally, I want to personally thank each PRH investor for your confidence in and support of our work. You have enabled our continued progress. Your investments totaling approximately $30 million in an anti-dilutive fashion for common shareholders have empowered the revelation of an array of promising applications of Provectus’s rose bengal sodium in cancer and other diseases. I contend that the promise of these applications is being revealed by the exceptional physicians, researchers, and medical centers we are working with in our efforts to one day serve patients around the world.

Thank you, Alyssa.

Alyssa.

Thank you, Ed and Dominic.

Thank you, everyone, for attending the First Quarter 2024 Conference Call of Provectus Biopharmaceuticals. We look forward to speaking with you this summer.

Goodbye.