Provectus News Day: July 4, 2024

Annual meeting highlights • Former PV-10-treated melanoma patient update • Chairman & CEO's 13D filing • EyeCo update • 3rd quarter conference call plans

Provectus Biopharmaceuticals, Inc. (OTCQB: PVCT) uses GlobeNewswire-distributed press releases, U.S. Securities and Exchange Commission (SEC) filings, and its website to disclose material financial and operational information to shareholders, prospective investors, the media, and those interested in the Company. Substack is a means of disclosing observations about Provectus and for complying with disclosure obligations under SEC Regulation FD.

2024 Annual Stockholder Meeting (June 20th)

Provectus held its 2024 annual stockholder meeting (2024 Annual Meeting) on Thursday, June 20th at the Hilton Knoxville, located at 501 West Church Avenue, Knoxville, Tennessee.

For the first time, annual meeting activities were made accessible by Zoom Webinar to shareholders and other interested parties.

A. Some Stats

Twenty shareholders attended in person and 86 shareholders and other viewers joined by Zoom, totaling 106 participants:

51% of 2024 Annual Meeting virtual attendees stayed for and viewed the entire meeting, which included formal shareholder activities, remarks by Ed Pershing, Provectus’s Chief Executive Officer (CEO) and Chairman of its board of directors (Board), a company presentation, and a question & answer (Q&A) panel. The meeting lasted more than two hours,

79% viewed all of the company presentation and Q&A panel (virtual attendees asked questions of the panel), and

84% viewed most of the meeting.

For the Company’s First Quarter 2024 Conference Call, 134 people dialed in.

B. Presentation Materials

Dominic Rodrigues, Provectus’s President and Board Vice Chairman provided company updates via a presentation titled “Rose Bengal Sodium: A Bioactive Molecule.”

Presentation slides are displayed below.

Included in the presentation was a list of Company achievements since the 2023 annual stockholder meeting:

The full 2024 Annual Meeting slide deck is available on Provectus’s website here.

C. Provectus Stockholder Proposals

Company stockholders voted on six proposals, which are described below together with their results (all proposals passed); a Form 8-K for which was filed on June 21st:

Proposal 1: Stockholders elected all recommended directors for a term of one-year, consistent with the recommendation of Provectus’s Board.

Proposal 2: Stockholders approved the advisory vote on the compensation of the Company’s named executive officers, consistent with the Board’s recommendation.

Proposal 3: Stockholders ratified the selection of Marcum LLP as Provectus’s independent registered public accounting firm for 2024, consistent with the Board’s recommendation.

Proposal 4: Stockholders authorized the Board to amend the Company’s Certificate of Incorporation, as amended by the Certificate of Designation of Series D Convertible Preferred Stock and Certificate of Designation of Series D-1 Convertible Preferred Stock (Certificates of Designation), to effect a reverse stock split of Provectus’s common stock, Series D Convertible Preferred Stock, and Series D-1 Convertible Preferred Stock at a ratio of between 1-for-10 and 1-for-50, where the ratio would be determined by the Board at its discretion, and to make corresponding amendments to the Certificates of Designation to provide for the proportional adjustment of certain terms upon a reverse stock split, consistent with the Board’s recommendation.

Proposal 5: Stockholders authorized the Board, given the Company’s stockholders’ approval of Proposal 5, to amend Provectus’s Certificate of Incorporation, as amended by the Certificates of Designation, to decrease the number of authorized shares of the Company’s common stock and preferred stock by the same reverse stock split ratio determined by the Board, consistent with the Board’s recommendation.

Proposal 6: Stockholders approved the Provectus Biopharmaceuticals, Inc. 2024 Equity Compensation Plan, consistent with the Board’s recommendation.

In response to a question during the Q&A panel, Company leadership reiterated its position regarding the approval of Proposal 4 for a reverse stock split (RSS): There are no current plans for a Provectus RSS. The Company sought annual stockholder approval for such authorization as a tactical option; a stockholder proposal for an RSS (and a decrease in the number of authorized shares of common and preferred stock by the same RSS ratio) was first put to a vote for the 2023 Annual Meeting.

An RSS is not a means to an end, but rather a means to address the Company’s capital structure, potentially increase Provectus’s stock price, potentially facilitate an up-list to a major stock exchange, and make the Company’s common stock more attractive to a broader range of investors (e.g., institutional , professional, other members of the investing public). Provectus may undertake an RSS when the Company’s Board believes doing so would be in the best interests of shareholders. If an RSS is not put into effect prior to the 2025 Annual Meeting, Company leadership would again seek stockholder approval for RSS authorization.

D. Guidance

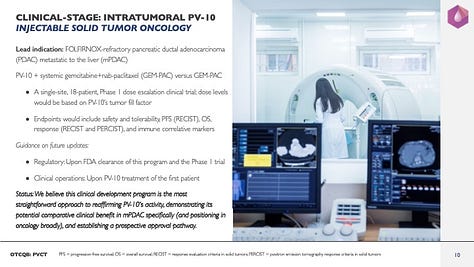

In response to a question during the Q&A panel, Company leadership discussed providing guidance about Provectus’s lead indication in injectable solid tumor oncology for investigational intratumoral cancer immunotherapy PV-10 (rose bengal sodium [RBS]): FOLFIRNOX-refractory pancreatic ductal adenocarcinoma (PDAC) metastatic to the liver (mPDAC), where we would compare locally-administered PV-10 + systemically-administered gemcitabine+nab-paclitaxel (GEM-PAC) versus GEM-PAC in a Phase 1 dose escalation clinical trial.

Provectus plans to provide:

a regulatory update upon FDA clearance of this mPDAC program and the Phase 1 trial, and

a clinical operations update upon PV-10 treatment of the first mPDAC patient.

In further response to the question, Company leadership said their goal and hope is to start the trial before the end of 2024, but no explicit guidance was given at the meeting.

Other comments by or guidance from Provectus leadership included:

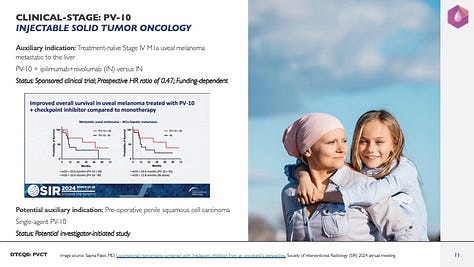

Auxiliary indication in injectable solid tumor oncology: Treatment-naïve Stage IV M1a uveal melanoma (UM) metastatic to the liver (mUM)

PV-10 + ipilimumab+nivolumab (Yervoy®+Opdivo®; IN) versus IN

Potentially a Phase 2 randomized controlled trial

Status: Sponsored clinical trial

Prospective HR ratio of 0.47 (i.e., a 53% reduction in death compared to IN alone)

Funding-dependent,

Potential auxiliary indication in injectable solid tumor oncology: Pre-operative penile squamous cell carcinoma (Penile SCC)

Single-agent PV-10

A Phase 1 clinical trial

Status: Potential investigator-initiated study,

Clinical stage asset in dermatology

Topical PH-10 (RBS)

Auxiliary indications: Skin diseases, conditions, and disorders, and skin aging

Further advancement of PH-10 would be based on the full results of ongoing, broad-ranging, non-clinical research into RBS’s mechanisms of action

Status: We believe this non-clinical work, which includes RNA sequencing among other types of analyses, is critical to fully understanding and optimally positioning PH-10’s potential clinical benefit for the treatment of skin diseases, conditions, and disorders,

Clinical stage asset in ophthalmology

Topical PV-305 (RBS)

Auxiliary indications: Infectious keratitis

Rose bengal photodynamic antimicrobial therapy (RB PDAT) is the subject of two international Phase 3 randomized controlled trials for acanthamoeba and fungal (NCT05110001) and bacterial (NCT06271772) keratitis. RB PDAT has been used to treat types of infectious keratitis patients in four countries to date (i.e., the U.S., India, Brazil, and Mexico)

A data readout of NCT05110001 is planned for Q4 2024

Status: We plan to spinout an ophthalmology-focused start-up biotechnology company (“EyeCo”) in Q3 2024 (see EyeCo Spinout Update (July 4th) below),

Proof-of-concept in vivo program in full-thickness cutaneous wound healing

Route of administration: Topical RBS

“RBS accelerates wound closure, increases collagen, and improves trans epidermal water loss at day 14 after injury. These beneficial effects were achieved at concentrations that were safe and did not exhibit any toxic effects” (research collaborator University of Texas Medical Branch at Galveston)

Status: A large animal (i.e., pig) trial may commence in Q4 2024

A late-stage clinical trial (versus a comparator) could potentially follow,

Proof-of-concept in vivo program in canine soft tissue sarcomas

Route of administration: Intratumoral RBS

Our research collaborator (University of Tennessee College of Veterinary Medicine) has mostly completed in vitro testing and is currently conducting non-clinical safety studies on rabbits and, potentially later, beagles

Status: A Phase 1 clinical trial may commence in Q4 2024,

Proof-of-concept in vivo program in oncology and hematology

Route of administration: Oral RBS

Status: We believe RBS’s multifaceted, simultaneous and temporal stimulatory and inhibitory co-targeting, and immune-related mechanisms of action in cancer may have the potential to position an orally-delivered drug formulation for broad-spectrum use in both oncology and hematology (research collaborator: University of Calgary’s Cumming School of Medicine),

In vivo discovery program in infectious diseases

Routes of administration: Topical RBS, Oral RBS

Status: We believe RBS can potentially be applied to gram-positive, gram-negative, and drug-resistant infections (research collaborator: University of Tennessee Health Science Center’s College of Pharmacy),

In vivo discovery program in tissue regeneration and repair

Routes of administration: Topical RBS, Systemically-delivered RBS

Status: Our research collaborator (University of Nevada, Las Vegas) is preparing a manuscript for potential publication, and

In vivo discovery program in proprietary targets

Status: To be communicated.

Former PV-10 Patient Brad (“Tex”) Evans Update (July 1st)

In April 6, 2024 Provectus Substack post titled “Stage IV Melanoma: ‘…the company that saved my life’,” we discussed a melanoma patient’s testimonial about his experience with PV-10 in the Company’s clinical trial where he received locally-administered PV-10 + systemically-administered immune checkpoint inhibitor Keytruda® (pembrolizumab). He had given Provectus his permission to write the Substack post, reviewing it before it was published, and to provide his further medical updates.

In June 2019, a then-patient (“Tex”) in Provectus’s Phase 1b clinical trial of PV-10 and Keytruda for checkpoint-naïve Stage IV cutaneous melanoma (i.e., the main cohort of multi-cohort NCT02557321) reached out to the Company to ask if he could speak at Provectus’s 2019 annual stockholder meeting in Knoxville, Tennessee.

In 2020, Provectus presented 2-year landmark survival, response, safety, and other data from Tex’s clinical trial at the European Society for Medical Oncology (ESMO) Virtual Congress, including 62% overall survival (OS) (55% for historical Keytruda alone) and median OS (mOS) not reached (mOS also not reached for historical Keytruda alone). A link to a copy of the ESMO poster presentation may be found here. The study also achieved an overall response rate (ORR; by RECIST) of 67%, a 10% complete response (CR), and an estimated progression-free survival (PFS; by RECIST) of 11.7 months.

Tex, who by 2018 had achieved CR with no evidence of disease (NED), wanted to share his story with shareholders and his praise for the impact that he felt PV-10 had had on the course of his disease, his treatment outcome, and ultimately his life.

Earlier this week, Tex let us know he had completed his last semi-annual checkup at MD Anderson Cancer Center (MDACC) in Houston, Texas a few weeks ago (MDACC was the clinical trial site where Tex participated and was treated with PV-10), that “once again all was good,” and that MDACC moved his semi-annual surveillance schedule to an annual one.

Earlier this year, Tex began racing in the 2024 Ferrari Racing Challenge, 488 Shell Class. Having completed Round 1 at Circuit of the Americas (April 24 – 28) and Round 2 at Laguna Seca (May 15 – 19), he said he was preparing for Round 3 at Watkins Glen International (July 10 – 14). You can watch the races on Peacock (NBC) or YouTube

(search Ferrari Challenge Watkins Glen 2024, 488 Shell class). Tex sent us more pictures.

Ed Pershing’s Schedule 13D Filing (July 3rd)

Ed filed a Schedule 13D with the SEC on July 3, 2024, reporting his 5.17% ownership of the Company.

A Schedule 13D filing is a form that must be submitted by anyone who acquires more than 5% of a company's shares. The form is part of the Securities Exchange Act of 1934 and, among other things, is intended to provide transparency regarding significant ownership stakes in public companies.

EyeCo Spinout Update (July 4th)

During the company update portion of the 2024 Annual Meeting, Company leadership guided that they plan to spinout an ophthalmology-focused start-up biotechnology company (i.e., “EyeCo”) in the third quarter of 2024.

To date, with input from the Ophthalmic Biophysics Center (OBC) at Bascom Palmer Eye Institute (BPEI) at the University of Miami Miller School of Medicine:

a name has been selected and URLs have been reserved,

a logo has been developed, along with its color palette, and

initial branding has been created.

A discussion of EyeCo can be found in the March 28, 2024 Provectus Substack post titled “Ophthalmology Deal Structure.”

Further related reading includes:

the March 22, 2024 Provectus Substack post titled “Building Trust: Bascom Palmer Eye Institute, Provectus Biopharmaceuticals, and RBS PDAT”, and

our March 27, 2024 press release titled “Provectus Biopharmaceuticals Announces Exclusive Worldwide License Agreement with University of Miami for Photodynamic Antimicrobial Treatment of Different Eye Infections with Rose Bengal Sodium.”

Third Quarter 2024 Conference Call Plans (September)

Provectus plans to hold a third quarter 2024 conference call, with a Q&A portion, by or before the end of September.

Forward-Looking Statements

The information provided in this Provectus Substack Post may include forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, relating to the business of Provectus and its affiliates, which are based on currently available information and current assumptions, expectations, and projections about future events and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are often, but not always, identified by the use of words such as “aim,” “likely,” “outlook,” “seek,” “anticipate,” “budget,” “plan,” “continue,” “estimate,” “expect,” “forecast,” “may,” “will,” “would,” “project,” “projection,” “predict,” “potential,” “targeting,” “intend,” “can,” “could,” “might,” “should,” “believe,” and similar words suggesting future outcomes or statements regarding an outlook.

The safety and efficacy of Provectus’s drug agents and/or their uses under investigation have not been established. There is no guarantee that the agents will receive health authority approval or become commercially available in any country for the uses being investigated or that such agents as products will achieve any revenue levels.

Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this Provectus Substack Post are made as of the date hereof or as of the date specifically specified herein, and the Company undertakes no obligation to update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except in accordance with applicable securities laws. The forward-looking statements are expressly qualified by this cautionary statement.

Risks, uncertainties, and assumptions include those discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including those described in Item 1A of Provectus’ Annual Report onForm 10-K for the period ended December 31, 2023 and on Form 10-Q for the period ended March 31, 2024.