Provectus Biopharmaceuticals, Inc. (Provectus) held its Annual Meeting of Stockholders on Wednesday, June 21, 2023 at the Hilton Knoxville located at 501 West Church Avenue, beginning at 4:00 p.m. Eastern Time (the 2023 Annual Stockholder Meeting).

Provectus’s Form 8-K filed on June 21, 2023 provided a link to a copy of the 2023 Annual Stockholder Meeting presentation slides.

The 2023 Annual Stockholder Meeting agenda comprised:

The Company issued a press release (PR) today to announce the results of shareholder voting, “Provectus Biopharmaceuticals Announces Stockholder Approval to Undertake Reverse Split of Outstanding Equities and Reduce Number of Authorized Equities by Same Ratio.”

Ed Pershing, Chairman of Provectus’s Board of Directors (Board) said, via the PR:

“I want to express my sincere appreciation and the sincere appreciation of our directors, officers, employees, and staff to all of our stockholders for your active participation in the voting process as well as your support of our business direction and management, as evidenced by these favorable voting results. Your continued interest in and support of Provectus is welcomed and greatly appreciated.”

Shareholder meeting activities comprised:

Shareholders approved the recommendations of Provectus’s Board for six proffered proposals:

The election of the Company’s directors.

An advisory vote on the approval of the compensation of Provectus’s named executive officers.

An advisory vote on the frequency of the above mentioned advisory vote on compensation.

The ratification of the Company’s independent registered public accounting firm.

The authority for Provectus’s Board to undertake a reverse stock split (RSS) of the Company’s outstanding equities (e.g., preferred and common stocks).

The authority for Provectus’s Board to undertake a reduction in the number of the Company’s authorized equities (ASR) by the same ratio chosen for the RSS.

Provectus’s Form 8-K filed on June 22, 2023 provided details of shareholder voting on the Board’s six proposals and included a brief description of and the vote tabulation for each proposal:

The proposal of the election of directors passed with [an average of] 44% FOR of shares outstanding and 96% FOR of shares voted.

The proposal of an advisory vote on compensation passed with 43% FOR of shares outstanding and 94% FOR of shares voted.

The proposal of a one-year frequency of advisory vote on compensation passed with 43% FOR of shares outstanding and 94% FOR of shares voted.

The proposal of the independent accounting firm passed with 67% FOR of shares outstanding and 99% FOR of shares voted.

The proposal of the authority to seek an RSS passed with 61% FOR of shares outstanding and 90% FOR of shares voted.

The proposal of the authority to seek an ASR passed with 61% FOR of shares outstanding and 91% FOR of shares voted.

Ed added, via the PR:

“The Company’s Board understands its responsibility to evaluate and determine whether and when a reverse stock split of Provectus’s outstanding equities and reduction of authorized shares are in the best interests of the Company and our stockholders.”

Following the formal portion of the 2023 Annual Stockholder Meeting, Provectus provided an update about, among other things, the Company’s clinical development, regulatory affairs, drug discovery, manufacturing, intellectual property, business development, and corporate development activities.

Ed’s vision for Provectus has been to build the Company into a commercial pharmaceutical company offering globally accessible and affordable drugs. More recently, we communicate this opportunity as pursuing cures, not treatments, and living global health equity authentically every day.

The goal of Substack posts such as this is to directly and regularly communicate information, data, data analysis, and knowledge of Provectus’s work to Company shareholders, along with utilizing other channels such as Provectus press releases, the Company’s SEC filings, etc.

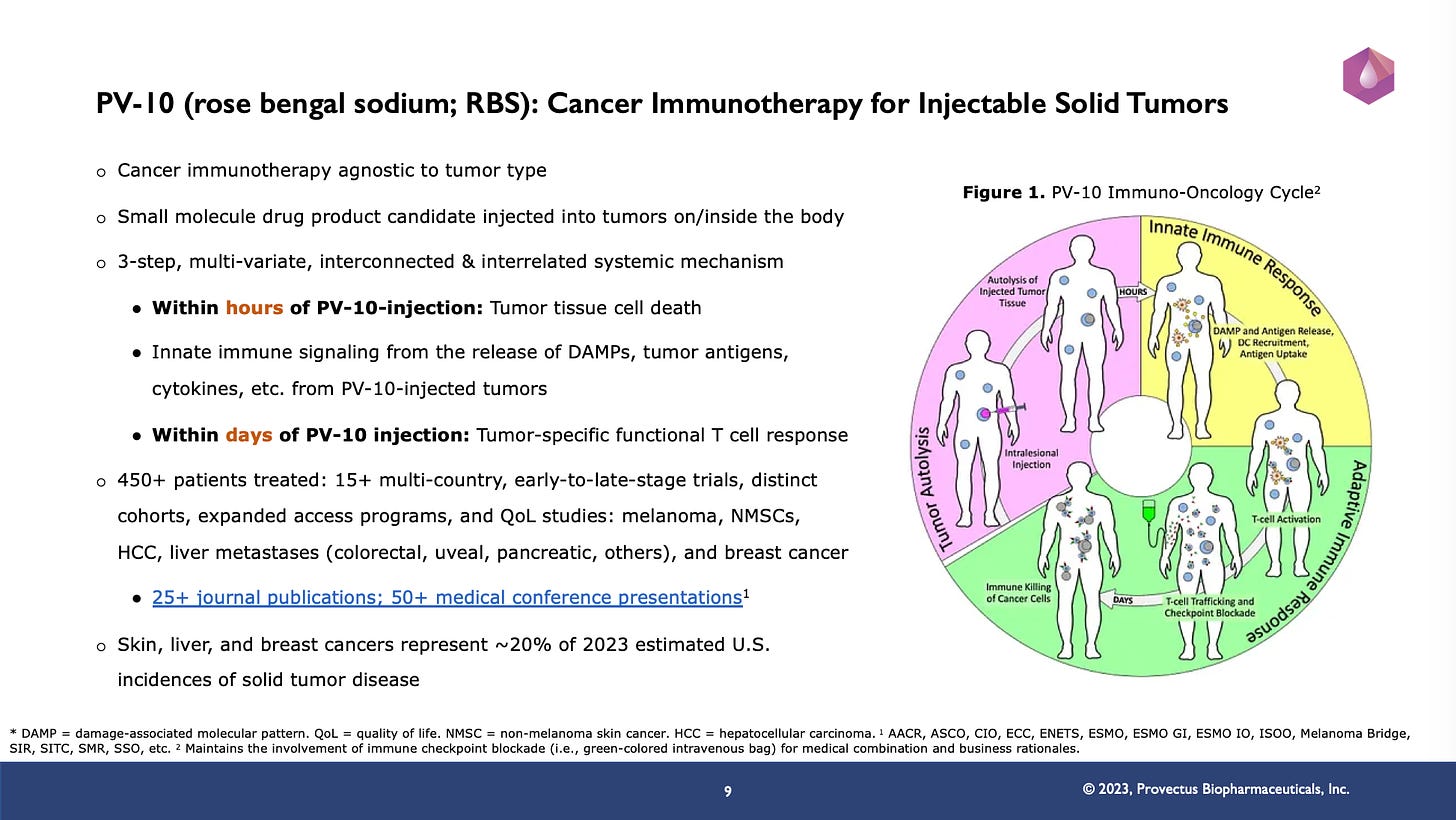

The point of slide #9 of the 2023 Annual Stockholder Meeting presentation slides (below) was to communicate that we believe PV-10 is a cancer immunotherapy, and that Provectus will endeavor to demonstrate (in Part Two of the Company’s clinical development program [CDP] for PV-10) that patients’ immunotherapeutic outcomes are largely due to PV-10 treatment.

The point of slide #10 (below) was to communicate, essentially, that the clinical data generated by Part One of PV-10’s CDP, while, among other things, substantial (e.g., 450+ patients treated), diverse (e.g., different cancer indications, multiple different settings, consistent), and reasonably objectively demonstrative of safety (single-agent), activity (single-agent), orthogonality (combination), and synergy (combination) had certain process and data gaps (that will be addressed in Part Two of PV-10’s CDP), such as PV-10 was neither given enough nor enough times to clinical trial patients.

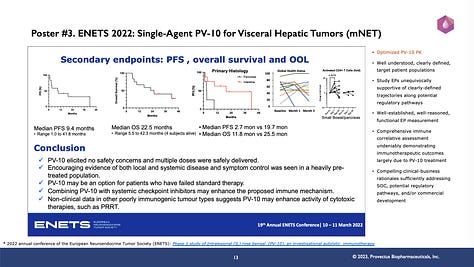

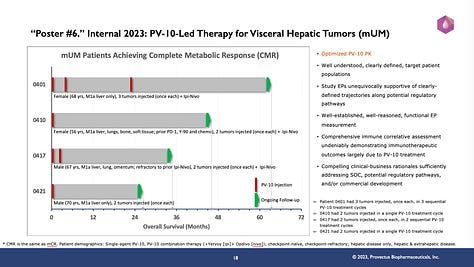

No where is this reality that patients were not treated with enough PV-10 (i.e., moving well beyond confirming safety and tolerability to maximizing efficacy) than in Provectus’s single-agent treatment of visceral hepatic tumors. This is the point of slide #s 11, 12, and 13 (below). Patients with primary liver cancer (i.e., pancreatic cancer metastatic to the liver [mPC], hepatocellular carcinoma [HCC], colorectal cancer metastatic to the liver [mCRC], and neuroendocrine tumors metastatic to the liver [mNET]) mostly received one injection of PV-10 to one hepatic tumor, once. Yet, from the data described in Provectus’s internal “poster” or the accepted medical conference presentation posters below, overall survival was notable:

1st-line mPC: 29 months,

HCC: median disease-specific survival (mDSS) not reached, range 0.1 to 112+ months, as of 2020,

mCRC: 26.8 months mDSS, range 3.0 to 97+ months, as of 2020, and

3rd-line mNET: 22.5 months median overall survival (mOS), range 5.5 to 42.3 months, as of 2022 (4 of 12 patients still alive as of 2023).

A little PV-10 may go a long way, but could/should more PV-10 go further?

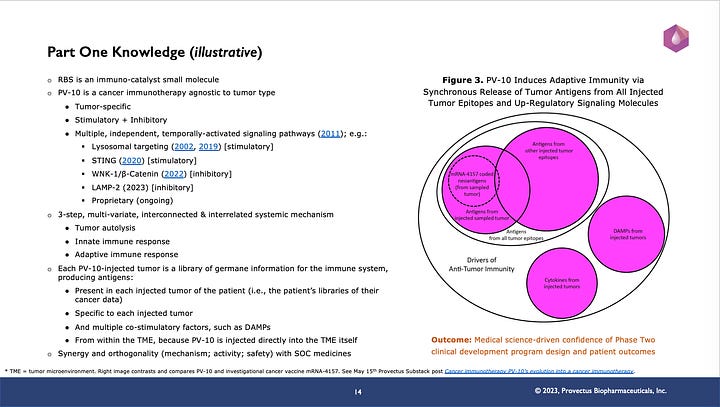

The point of slide #14 (below) is two-fold:

PV-10 cancer immunotherapy is both a stimulatory agent and an inhibitory one.

The knowledge gleaned from Part One of the Company’s CDP for PV-10, particularly manifested as the design principles for new clinical studies (see slide #15 below, provides great confidence in the potential outcomes of patients receiving PV-10 in new trials.

The point of slide #s 16, 17, and 18 (below) is that giving enough PV-10 should lead to good things:

Immune checkpoint blockade-naive, Stage III cutaneous melanoma: 50% complete response (CR) and 83% ORR by RECIST 1.1 criteria; Rapid CRs achieved within 15 to 27 weeks; Median PFS not reached during 2-year treatment interval and an 83% PFS rate; 100% OS rate for CRs and ongoing after 18 to 36 months of study follow-up.

Uveal melanoma metastatic to the liver (mUM): The achievement of metabolic compete response (mCR; or complete metabolic response [CMR]) in M1a-stage patients, whether receiving single-agent PV-10 or the combination of PV-10+Yervoy+Opdivo, whether naive or refractory to checkpoint blockade, or whether having hepatic-only or hepatic and extra-hepatic disease; four M1a mCRs (out of 14 M1a study patients) as of recently having OSs ranging from 2+ to 5+ years. mCRs received PV-10 injections to more than one hepatic tumor per cycle and received more PV-10 injection cycles.

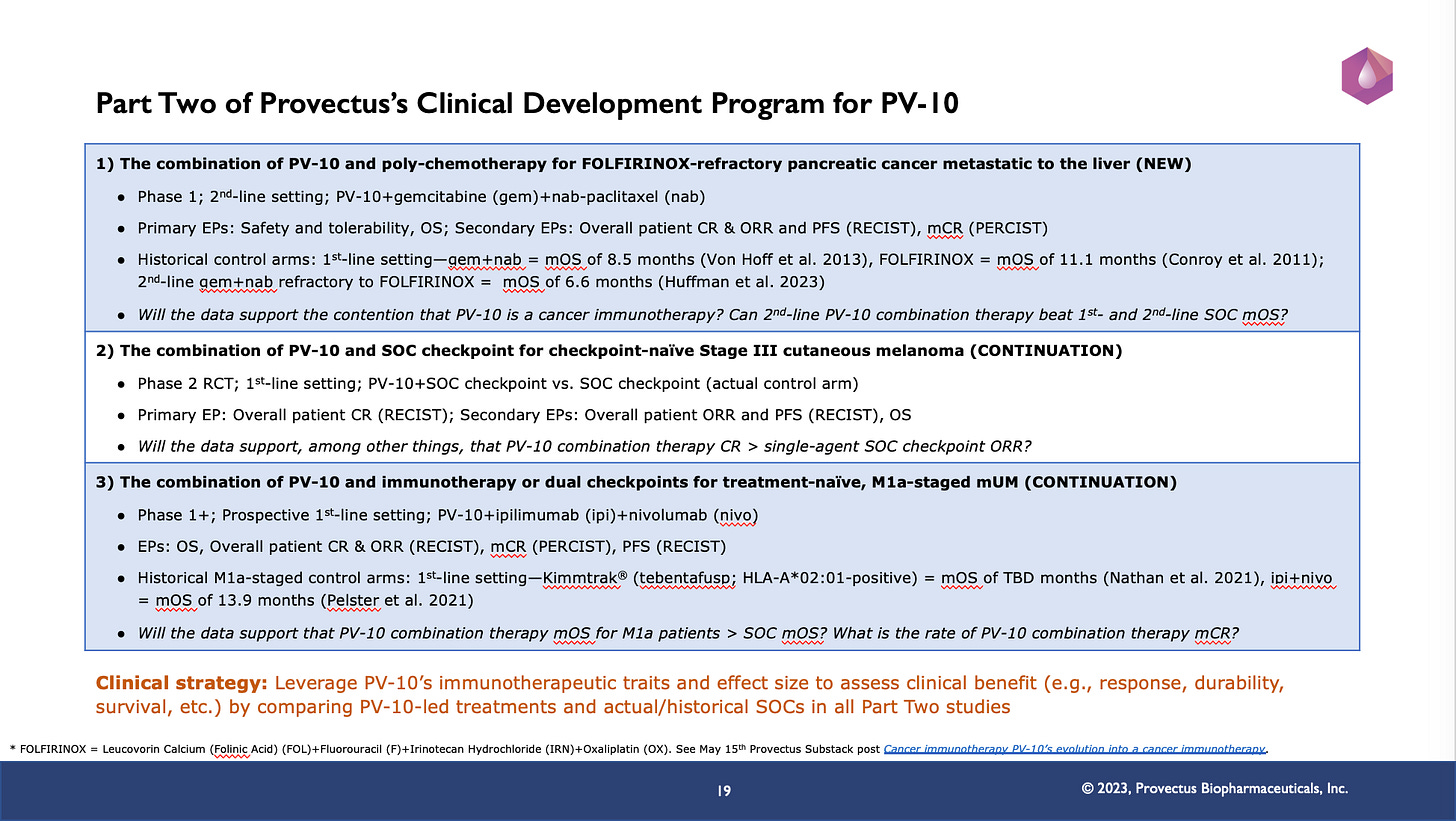

The point of slide #19 is to highlight the clinical strategy of Part Two of the Provectus’s CDP for PV-10: Leverage PV-10’s immunotherapeutic traits and effect size to assess clinical benefit (e.g., response, durability, survival, etc.) by comparing PV-10-led treatments and actual/historical SOCs in all Part Two studies.

The point of slide #20 is to communicate that, while the Company is focused on the regulatory and commercial advancement of PV-10, Provectus also has the business goal of demonstrating the potential of pharmaceutical-grade RBS-formulated drug product candidates for different diseases.

The point of slide #21 (below) is to communicate the business goal of establishing the commercial differentiation, viability, and scale of pharmaceutical-grade RBS drug substance (DS) and RBS DS-based drug product (DP) candidates. In other words, Provectus’s pharmaceutical-grade RBS is indeed proprietary.

The point of slide #s 22, 23, and 24 (below) is to highlight the Company’s achievements since the 2022 Annual Stockholder Meeting.

A Q&A session with the Company’s Board followed the company update.

Provectus’s specific regulatory or commercial activities for any specific geographic jurisdiction or region were not discussed. At multiple different points during the 2023 Annual Stockholder Meeting, the Company noted that activities and outcomes would be disclosed via press release, SEC filing, etc. if and when completed, achieved, and/or accomplished. Provectus also plans to communicate with shareholders in periodic, regular, virtual meeting/conference call settings in the future.

Where to Find Available Information

Investors and others should note that Provectus Biopharmaceuticals, Inc. (the Company) uses, and will continue to use, press releases distributed by GlobeNewswire®, filings with the Securities and Exchange Commission (SEC), and the Company's website (provectusbio.com) to disclose material financial and operational information to the Company's shareholders, prospective investors, the media, and others interested in the Company. The Company also intends to use certain social media accounts as a means of disclosing information and observations about the Company and its business, and for complying with the Company's disclosure obligations under Regulation FD: the Provectus Substack account (provectus.substack.com), the @ProvectusBio Twitter account (twitter.com/provectusbio), and the Company's LinkedIn account (linkedin.com/company/provectus-biopharmaceuticals). The information and observations that the Company posts through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following the Company's press releases, SEC filings, and website. The social media channels that the Company intends to use as a means of disclosing the information described above may be updated from time to time.

Forward-Looking Statements

The information in Provectus’s Substack post may include “forward-looking statements,” within the meaning of U.S. securities legislation, relating to the business of Provectus and its affiliates, which are based on the opinions and estimates of Company management and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek,” “anticipate,” “budget,” “plan,” “continue,” “estimate,” “expect,” “forecast,” “may,” “will,” “project,” “predict,” “potential,” “targeting,” “intend,” “could,” “might,” “should,” “believe,” and similar words suggesting future outcomes or statements regarding an outlook.

The safety and efficacy of the agents and/or uses under investigation have not been established. There is no guarantee that the agents will receive health authority approval or become commercially available in any country for the uses being investigated or that such agents as products will achieve any particular revenue levels.

Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on these forward-looking statements. The forward-looking statements contained in Provectus’s Substack are made as of the date hereof or as of the date specifically specified herein, and Provectus undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except in accordance with applicable securities laws. The forward-looking statements are expressly qualified by this cautionary statement.

Risks, uncertainties, and assumptions include those discussed in the Company’s filings with the SEC, including those described in Item 1A of:

the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and

Provectus’ Quarterly Report on Form 10-Q for the period ended March 31, 2023.

My hope for PV-10 is based on being a 2x Lynch Syndrome solid tumor survivor. I want this small molecule treatment to be available if I ever experience liver mets. I would like to see this medication applied to the neglected market of Sqamous Cell Carcinomas, especially Anal Cancer, in which the Standard of Care Nigro Protocol is a brutal treatment dating back to the 1960s.