VisiRose: Provectus’s Founded Entity in Ophthalmology

VisiRose is a new majority-owned subsidiary of Provectus

VisiRose Launch

VisiRose, Inc. (VisiRose) launched on Tuesday, December 10th with its press release, “VisiRose Introduces Revolutionary Therapy for Severe Eye Infections.” VisiRose’s website may be accessed here.

VisiRose is:

a newly-launched, privately-held, clinical-stage biotechnology company of publicly-traded Provectus Biopharmaceuticals (OTCQB:PVCT) (aka subsidiary, affiliate, etc.),

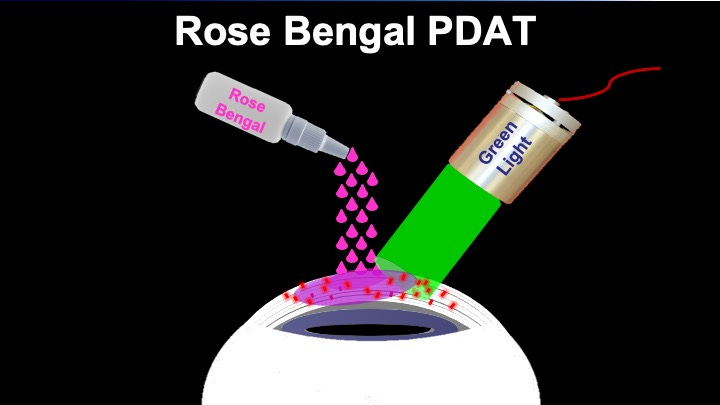

focused on commercializing the innovative ocular research of Bascom Palmer Eye Institute (BPEI)1 at the University of Miami2: Rose Bengal Photodynamic Antimicrobial Therapy (RB PDAT), a groundbreaking, non-invasive investigational treatment for infectious keratitis and other serious eye infections, and

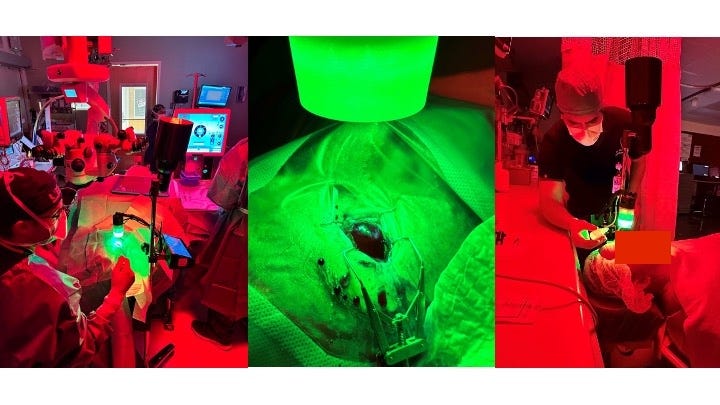

combining a formulation of Provectus's pharmaceutical-grade bioactive synthetic small molecule Rose Bengal Sodium (RBS) with BPEI’s green light-based medical device to treat severe eye infections caused by bacteria, fungi, and parasites.

BPEI is the University of Miami Leonard M. Miller School of Medicine’s ophthalmic care, research, and education center.

VisiRose from Provectus’s Perspective

Provectus announced VisiRose’s launch on Wednesday, December 11th with its press release, “Provectus Biopharmaceuticals Launches VisiRose, Provectus’s Founded Entity for Pharmaceutical-grade Rose Bengal Sodium-based Treatments in Ophthalmology.” Provectus also filed an associated 8-K, which may be accessed here.

At the outset:

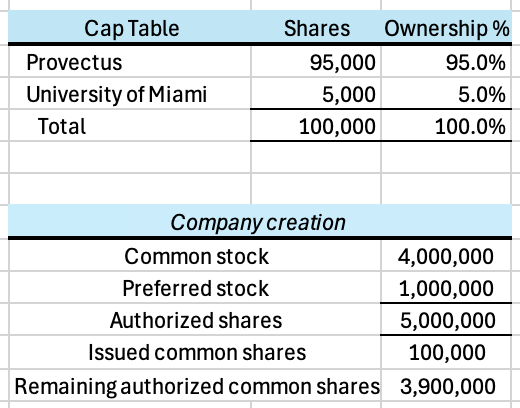

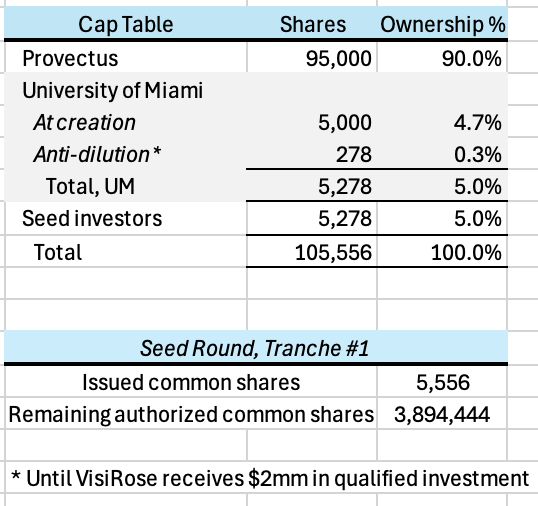

Provectus would own 95% of VisiRose and the University of Miami would own 5%, receiving 95,000 and 5,000 Class A common shares, respectively.

VisiRose’s board of directors would comprise Provectus’s board:

Ed Pershing (chairman of Provectus’s and VisiRose’s boards, and also chief executive officer of Provectus),

Dominic Rodrigues (vice chairman of Provectus, and also president of Provectus), and

Dr. Jack Lacey and Webster Bailey (Provectus independent board members), and

VisiRoses’s management team would comprise:

Ed as board chairman,

Dominic as acting chief executive officer, and

Heather Raines as chief financial officer (she holds the same position at Provectus).

Seed Round Investment

As Provectus noted in the above-mentioned 8-K, on October 31, 2024, the Company entered into a non-binding seed round investment term sheet for VisiRose with non-related party investors (Seed Investors), subject to final review and contract finalization by Provectus’s board of directors.

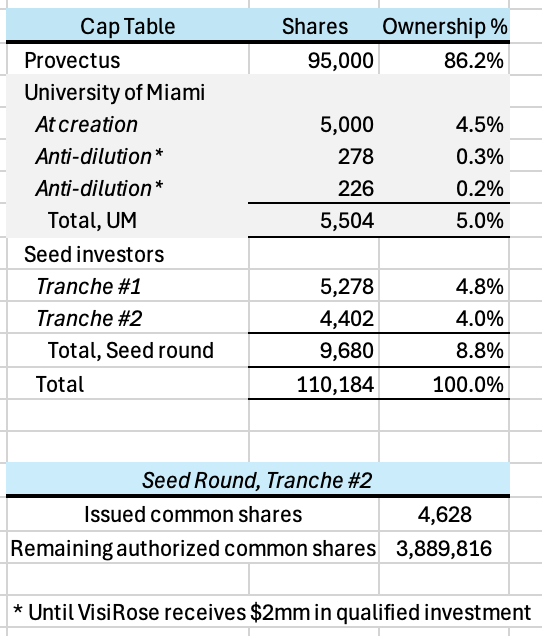

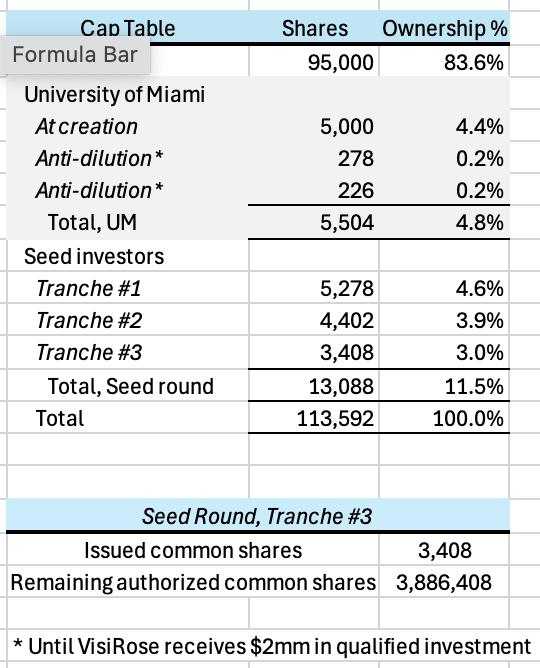

In VisiRose, the Seed Investors would invest:

$1 million upon request at the lesser of a post-money valuation of $20 million or a twenty-five percent (25%) discount (Discount) to the valuation of a potential Series A investment round (Series A Round) if its post-money valuation is less than or equal to $26.67 million,

$1 million within thirty (30) days of a pre-investigational new drug (IND) application submission meeting with the FDA at the lesser of a post-money valuation of $25 million or at the Discount if the Series A Round’s post-money valuation is less than or equal to $33.33 million, and

$1 million within two (2) years of their initial investment in VisiRose at the lesser of a post-money valuation of $33.33 million or at the Discount if the Series A Round’s post-money valuation is less than or equal to $44.44 million.

Assuming no Discount, the paper value of Provectus’s ownership of VisiRose is ~$18 million after Tranche #1, ~$22 million after Tranche #2, and ~$28 million after Tranche #3. Again, this is only value on paper. As a comparison, Provectus’s market capitalization on December 12th was ~$54 million.

Seed Round Use of Funds

The goals of the seed round investment are to:

Undertake a BPEI RB PDAT data assessment/gap analysis,

Do a pre-IND meeting submission for VisiRose RBS PDAT, and

Make the IND submission.

1. Data Assessment/Gap Analysis

This first step comprises:

Reviewing all available BPEI RB PDAT data from BPEI and other clinical sites, such as India, Brazil, Mexico, and elsewhere,

Developing the regulatory strategy for VisiRose RBS PDAT, and

Preparing for the regulatory affairs FDA process.3

This step is identifying:

any required studies for IND opening,

any potential clinical hold issues,

the possible scope of the meeting (i.e., key discussion topics),

all eligible expedited review programs, and

present and propose solutions to all potential regulatory complications of the development program.

2. Pre-IND Submission

This step would comprise:

Reviewing any new data (from Step #1) associated with BPEI RB PDAT, if necessary,

Adjusting regulatory strategy (from from Step #1), if necessary,

Leading VisiRose through the regulatory affairs FDA process.

This step would include:

preparing an official written request and agenda for the FDA,

preparing a Type B meeting package and meeting presentation materials (if required),

leading the FDA meeting/teleconference on behalf of VisiRose, and

following up on all FDA meeting teleconference activities, including meeting minutes preparation and filing with the FDA.

Steps #1 and #2 could take approximately four to six months (i.e., 1H25).

3. IND Submission

We will provide further guidance on this step after the completion and outcome of the above-mentioned pre-IND submission meeting.

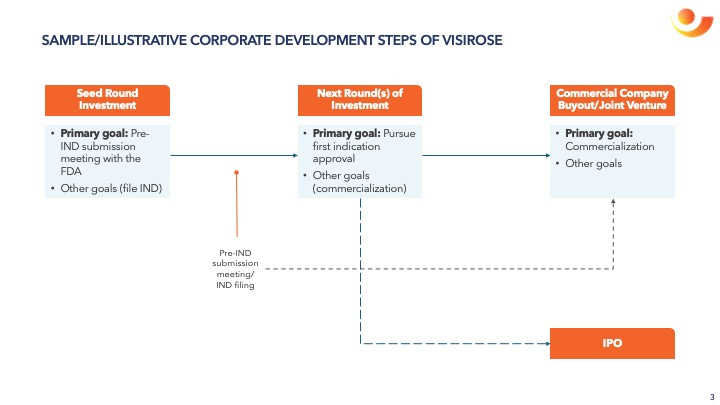

Next Round(s) of Investment

The outcome of the pre-IND submission meeting should define:

the regulatory pathway and its potential time, cost, and resource requirement,

VisiRose’s potential valuation, and

the next round(s) and corporate development step(s) of VisiRose.

Bascom Palmer Visit, December 6th

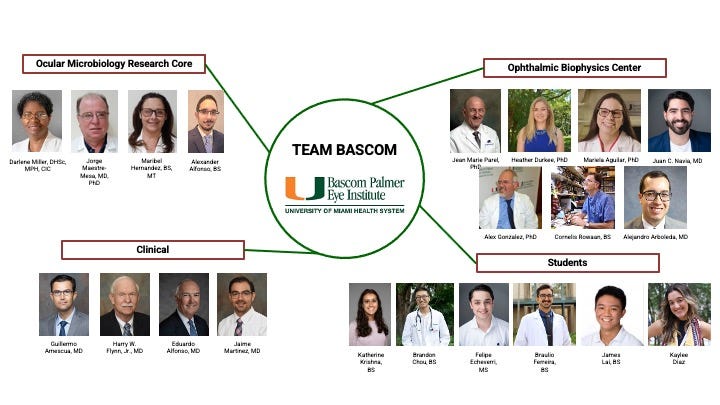

Ed, Dominic, and VisiRose’s Seed Investors met with the Ophthalmic Biophysics Center (OBC) and other Team Bascom members at BPEI on Friday, December 6th.

Some other slides from the presentation.

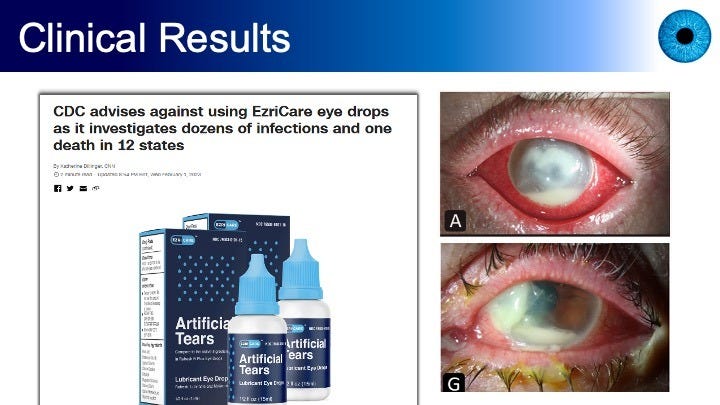

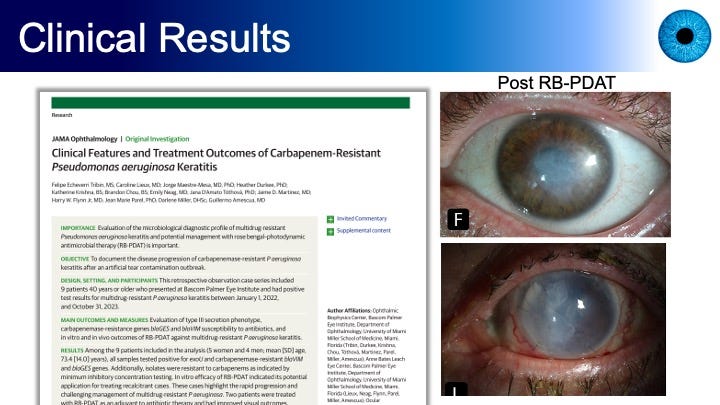

Figures 5 and 6, and the paper from which these images were drawn, describe the situation of the FDA recall of dozens of over-the-counter eye drops — artificial tears — in 2023 due to contamination and unsafe manufacturing practices. Most affected patients reported using EzriCare Artificial Tears.

BPEI’s medicla journal article noted that the carbapenem-resistant Pseudomonas aeruginosa strain was linked to 81 cases across 18 states, four deaths, permanent vision loss in 14 patients, and enucleation in four patients. Nine patients were treated at BPEI, two of whom received RB PDAT as an adjuvant to antibiotic therapy and had improved visual outcomes.

The BPEI authors concluded that “[t]his case series highlights the concerning progression in resistance and virulence of P aeruginosa and emphasizes the need to explore alternative therapies like RB-PDAT that have broad coverage and no known antibiotic resistance. The findings support further investigation into the potential effects of RB-PDAT for other multidrug-resistant microbes.”

VisiRose, Seed Investors, and OBC/Team Bascom

Forward-Looking Statements

The information provided in this Provectus Substack Post may include forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, relating to the business of Provectus and its affiliates, which are based on currently available information and current assumptions, expectations, and projections about future events and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Such statements are made in reliance on the safe harbor provisions of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are often, but not always, identified by the use of words such as “aim,” “likely,” “outlook,” “seek,” “anticipate,” “budget,” “plan,” “continue,” “estimate,” “expect,” “forecast,” “may,” “will,” “would,” “project,” “projection,” “predict,” “potential,” “targeting,” “intend,” “can,” “could,” “might,” “should,” “believe,” and similar words suggesting future outcomes or statements regarding an outlook.

The safety and efficacy of Provectus’s drug agents and/or their uses under investigation have not been established. There is no guarantee that the agents will receive health authority approval or become commercially available in any country for the uses being investigated or that such agents as products will achieve any revenue levels.

Due to the risks, uncertainties, and assumptions inherent in forward-looking statements, readers should not place undue reliance on these forward-looking statements. The forward-looking statements contained in this Provectus Substack Post are made as of the date hereof or as of the date specifically specified herein, and the Company undertakes no obligation to update or revise any forward-looking statements, whether because of new information, future events, or otherwise, except in accordance with applicable securities laws. The forward-looking statements are expressly qualified by this cautionary statement.

Risks, uncertainties, and assumptions include those discussed in the Company’s filings with the U.S. Securities and Exchange Commission, including those described in Item 1A of Provectus’ Annual Report on Form 10-K for the period ended December 31, 2023 and on Form 10-Q for the period ended September 30, 2024.

BPEI is ranked Best in Ophthalmology by both U.S. News & World Report and Ophthalmology Times. This is the 23rd time that BPEI has received the #1 ranking from US News since the publication began surveying U.S. physicians for its annual rankings 35 years ago (1994, 1998, 2004, 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023, and 2024). See here.

We worked with the University of Miami’s Office of Tech Transfer (OTT). See the article “How Discoveries Go to Market“ from the University of Miami Medicine Magazine.

The FDA’s Center for Drug Evaluation and Research (CDER) and Center for Devices and Radiological Health (CDRH) will be involved in the review and approval of this combination product (i.e., RBS + light-source medical device), with the primary filing style and lead agency determined by the component that provides the primary mode of action. In this case, CDER will most likely have primary jurisdiction. The Office of Combination Products (OCP) will determine.